USD/CHF has been correcting and consolidating at the edge of 0.9950 area for a few days in a row from where a break above the area is expected to lead to further bullish momentum. Yesterday FOMC meeting ended with the dovish policy update. The US central bank maintained the Federal Funds rate unchanged, thus leaving the market sentiment derived off the gains on the bullish side.

The US Federal Reserve recently sent the clearest signal that the cycle of monetary policy tightening is coming to an end while the pressure is rising on the economy as a result of a slowdown in the global economic growth. The US central bank left interest rates on hold and expressed the patient approach to every rate hike in the future. There are still chances of at least 2 rate hikes this year. FED Chairman Jerome Powell sounded quite dovish in the meeting while discussing tight financial conditions. The Funds Rate was left unchanged as expected at 2.50% which did not have much impact. The following press conference made the strongest impact, affecting USD growth along with the partial government shutdown recently. Tomorrow, US NFP report is going to be published which is going to include Average Hourly Earnings report which is expected to decrease to 0.3% from the previous value of 0.4%, Non-Farm Employment Change is expected to decrease to 165k from the previous figure of 312k and Unemployment Rate is expected to be unchanged at 3.9%.

On the other hand, recently Swiss Trade Balance report was published with a significant decrease to 1.90B from the previous figure of 4.75B which was expected to be at 4.55B. The downbeat economic report played a vital role injecting weakness for the Swiss Franc, but USD could not sustain it further. Moreover, KOF Economic Barometer report was published with a decrease to 95.0 from the previous figure of 96.4 which was expected to increase to 96.8 and Credit Suisse Economic Expectation report was also published with a significant decrease to -44.0 from the previous figure of -22.2. Tomorrow SECO Consumer Climate report is going to be published which is expected to have a slight increase to -5 from the previous figure of -6 and Retail Sales are expected to increase to 0.1% from the previous value of -0.5%.

Meanwhile, USD has been struggling for gains amid soft economic data and Fed's dovish rhetoric. On the other hand, CHF is struggling as well which enabled certain correction and indecision along the way. Ahead of US NFP and Switzerland's Retail Sales report tomorrow, the pair is likely to trade with higher volatility and sudden spikes. However, USD has a greater probability to take the lead in the coming days.

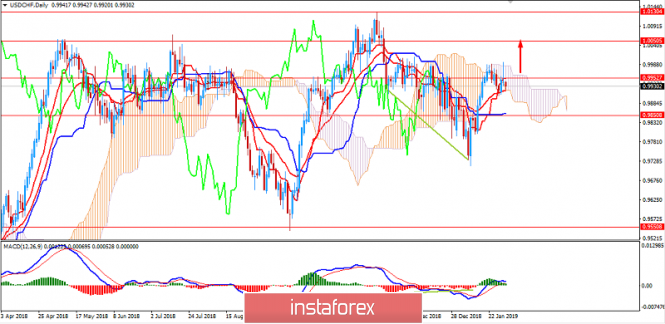

Now let us look at the technical view. The price is currently trading inside the Kumo Cloud resistance while also residing below 0.9950 with a daily close. The price is currently being held by dynamic level of 20 EMA, Tenkan, and Kijun line as support which is expected to carry it throughout the upward break which is expected to push the price higher towards 1.0050 resistance area in the coming days.

SUPPORT: 0.9550, 0.9700, 0.9850

RESISTANCE: 1.0050, 1.0130-50

BIAS: BULLISH

MOMENTUM: VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com