EUR/JPY has been quite corrective and volatile for a few weeks in a row. The price pushed impulsively lower below 128.50 with a daily close, yet indecisively to sustain the pressure. EUR has been quite positive amid the recent economic reports. Nevertheless, JPY managed to gain momentum because of strong fundamentals.

EUR asserted its strength today. However, the eurozone's economy is facing a challenge due to political and economic headwinds. Thus, EUR is struggling to gain ground against JPY. Today Spanish Services PMI report was published unchanged at 54.0 which was expected to decrease to 53.9, Italian Services PMI increased to 50.3 which was expected to be unchanged at 49.2, French Final Services increased to 55.1 which was expected to be unchanged at 55.0, German Final Services PMI remained unchanged as expected at 53.3, the eurozone's Final Services PMI increased to 53.4 which was expected to be unchanged at 53.1, and Retail Sales increased to 0.3%, following a 0.5% drop which was expected to be at 0.2%. Moreover, ECB President Draghi spoke about the positive economic development which helped EUR to sustain the overall pressure.

On the JPY side, the 2% inflation target along with BOJ is currently being adapted by Japanese Prime Minister Abe. Besides, Japan is likely to lead Free Trade next year, creating more businesses on the back of steady economic development. Recently Japan's Monetary Base report was published with an increase to 6.1% from the previous value of 5.9% which was expected to decrease to 5.7%. It helped the currency to gain impulsive momentum over EUR recently. On Friday, Japan's Household Spending report is going to be published which is expected to increase to 1.2% from the previous value of -1.6% and Average Cash Earnings is expected to increase to 1.0% from the previous value of 0.8%.

Meantime, the market is anticipating upbeat reports from Japan. Thus, JPY is performing better than EUR on the whole. Though EUR has gained good momentum today because of positive economic data, some troubles like unsettled Italy's budget deficit is bearish for EUR. As a result, JPY is expected to gain impulsive momentum in the coming days if Japan releases solid economic data.

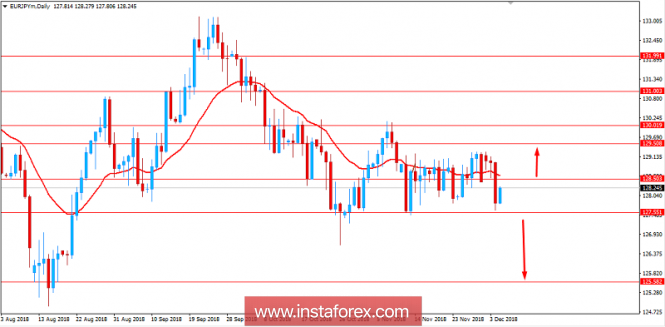

Now let us look at the technical view. The price is currently residing inside the corrective range between 127.50 to 129.50. The price recently sank below 128.50 amid impulsive bearish pressure which does not indicate the sustainability of the upcoming bearish pressure as it remains above 127.50 with a daily close. So, for further bearish momentum in this pair, a daily close below 127.50 is required whereas a daily close above 128.50 is expected to lead to further correction and an upward move towards 129.50 area. As the price remains below 130.00 area, the bearish bias is expected to continue.

SUPPORT: 125.50, 126.50, 127.50

RESISTANCE: 128.50, 129.50, 130.00

BIAS: BEARISH

MOMENTUM: VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com