EUR/AUD is currently trading below 1.5900 area amid the impulsive bearish momentum today after several corrections and higher volatility. Teh eurozone's economy is facing some headwinds like trade tensions and downbeat economic reports which made EUR lose momentum against AUD which is winning favor with investors.

Mario Draghi has recently confirmed that no rate hike will be announced before he retires as ECB President on October 2019. The ECB is currently quite silent about any kind of major changes, including an interest rate hike or monetary policy changes. Mario Draghi said at the press conference that the euro area's growth outlook has been downgraded due to downside risks because of persistent geopolitical factors and threat of protectionism, vulnerability in emerging markets, and financial market volatility. The statement had a great impact on the overall EUR momentum that caps its gains. Moreover, according to Germany's BGA trade body, "Germany is heading towards a huge disaster" which is expected to impact the overall eurozone in the future.

On the other hand, Australian consumer inflation edged up in annual terms in Q4 2018. It confirms that the interest rate will not be changed in the near future. Today Australia released a CPI report where consumer inflation edged up to 0.5% in Q4 on a quarterly basis which was expected to be unchanged at 0.4% and Trimmed Mean CPI remained flat at 0.4% as expected. Ahead of the election in Australia this year, the domestic economy could regain momentum unless external pressure deals a blow to it.

Meanwhile, EUR is on the verge of high pressure which is expected to impact its gains in the long run, so that EUR could lose steam against AUD. As Australia continues with positive economic data, AUD is going to extend strength versus EURO in the coming days.

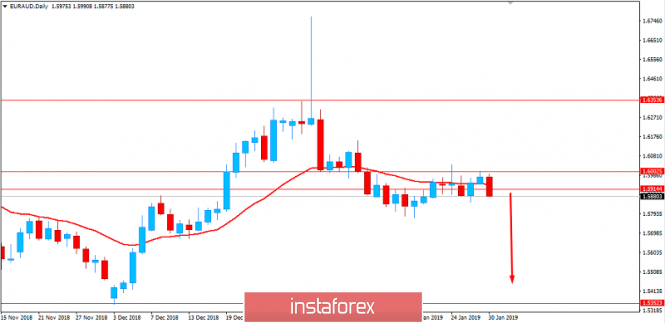

Now let us look at the technical view. The price is currently engulfing the recent bullish momentum with a daily candle. If the price can sustain throughout the day and close below 1.5850 area with a daily close, then the pair will retain bearish momentum towards 1.5500 and later towards 1.5350 support area. As the price remains below 1.60 area with a daily close, the bearish bias is expected to continue further.

SUPPORT: 1.5350, 1.5500

RESISTANCE: 1.5900, 1.6000

BIAS: BEARISH

MOMENTUM: VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com