AUD/JPY has been consolidating at the edge of 78.50 for a few days in a row. The price is expected to climb higher, breaking above the resistance areas to establish sustainable bullish momentum.

Australia has been hurt because of the US-China trade war. The upside of the situation is that AUD can regain momentum. Today Australia released a CPI report where consumer inflation edged up to 0.5% in Q4 on a quarterly basis which was expected to be unchanged at 0.4% and Trimmed Mean CPI remained flat at 0.4% as expected. The pair was trading without any clear bias for a few weeks due to indecision with JPY. Now AUD is expected to assert itself in light of the better-than-expected CPI report. Meanwhile JPY is struggling for gains. Ahead of the election in Australia this year, the domestic economy could regain momentum unless external pressure deals a blow to it.

On the other hand, Japan is also quite concerned about the US-China Trade decision which may also affect the Japanese economy by a certain extent. Japan brought forward its projection for achieving a primary budget surplus by one year to 2026 fiscal year today because of the expectations for slower growth in welfare spending by the government amid a tax revenue increase. The latest projection is unlikely to solve the large public debt burden which is almost twice the size of the whole economy. Today Japan's Retail Sales report was published with a slight decrease to 1.3% from the previous value of 1.4% but the actual result was better than the forecast of 0.9 and Consumer Confidence Index decreased to 41.9 from the previous figure of 42.7 which was expected to be at 42.5. Ahead of BOJ Summary of Opinions tomorrow, JPY is likely to lose steam.

Meantime, AUD is expected to assert its strength against JPY as JPY has been hurt by downgraded forecasts and mixed economic reports.

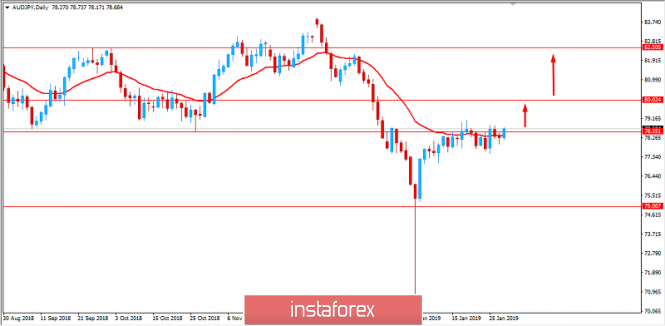

Now let us look at the technical view. The price is currently moving higher above 78.50 area which is expected to extend gains towards 80.00 area and towards 82.50 resistance area in the coming days. The price is being intersected by the dynamic level of 20 EMA currently which is expected to push the price much higher as it is trading below as support for the bullish momentum. As the price remains above 77.00 area, the bullish pressure is expected to continue further.

SUPPORT: 75.00, 77.00

RESISTANCE: 78.50, 80.00, 82.50

BIAS: BEARISH

MOMENTUM: VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com