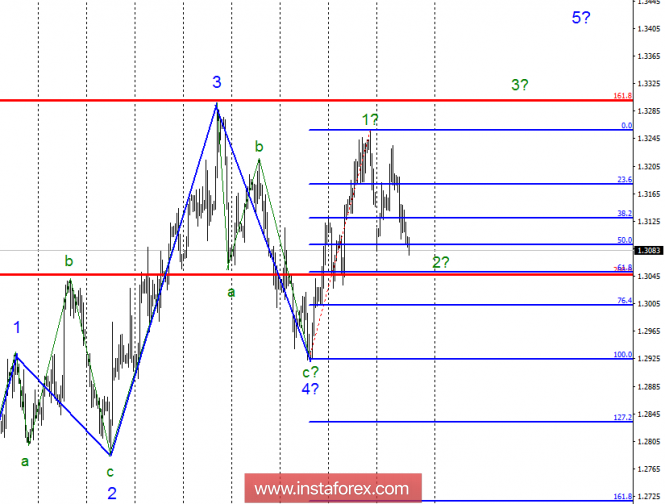

Wave counting analysis:

During the October 17 trading session, the GBP / USD currency pair fell by 75 basis points, so the expected wave 2 takes the 3-wave form and continues its construction. If this is true, then the decline will continue with targets located near the calculated levels of 61.8% and 76.4% Fibonacci. An unsuccessful attempt to break through one of these levels can lead to the departure of quotes from the lows reached and the completion of wave 2. However, for further growth of the pair, within wave 3, you will need "good" information about Brexit negotiations. Otherwise, it may be necessary to make adjustments to the current wave marking.

The objectives for the option with purchases:

1.3258 - 0.0% according to Fibonacci

1.3300 - 161.8% of Fibonacci

The objectives for the option with sales:

1.3052 - 61.8% of Fibonacci

1,3003 - 76.4% of Fibonacci

General conclusions and trading recommendations:

The currency pair GBP / USD continues to build the estimated wave 5 and the internal wave 2. Thus, I recommend keeping sales open with targets around 1.3052 and 1.3003. However, opening up new sales is now quite risky. Any information from the EU summit on the Brexit negotiations can greatly affect the movement of the pair, and the working version of the current wave marking can change.

The material has been provided by InstaForex Company -

www.instaforex.com