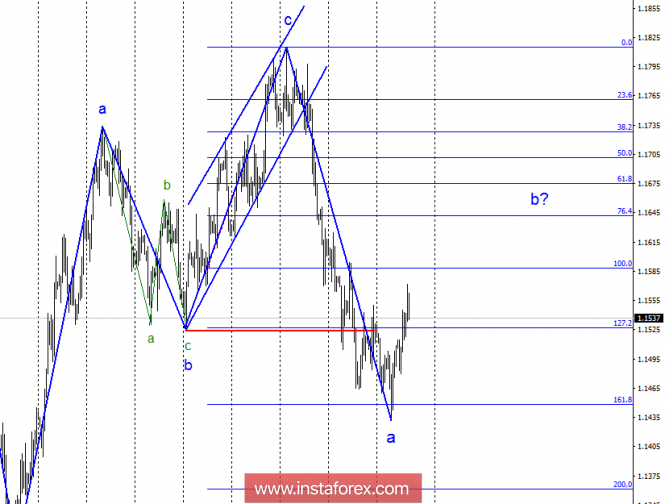

Wave counting analysis:

In the course of Wednesday trading, the EUR/USD pair rose by 30 bp, thus, this confirms the transition to the construction of an upward wave b in the framework of the supposedly 3-wave downward structure. If this is true, then the increase in quotations will continue with targets located near the estimated marks of 100.0% and 76.4% Fibonacci. After the completion of b-wave construction, the reduction of quotations within wave c is expected to continue. However, wave b can absolutely turn out any in terms of size, since much will depend on the background news now. Today, there will be a report on inflation in the United States.

Sales targets:

1.1446 - 161.8% Fibonacci

1.1361 - 200.0% Fibonacci

Purchase targets:

1.1588 - 100.0% Fibonacci

1.1641 - 76.4% Fibonacci

General conclusions and trading recommendations:

The unsuccessful attempt in breaking the 1.1446 mark signals a high degree of probability that wave a will end. Thus, I recommend buying the pair now with targets located near the estimated levels of 1.1588 and 1.1641. An unsuccessful attempt to break through one of the target marks may lead to the completion of the construction of the ascending wave.

The material has been provided by InstaForex Company -

www.instaforex.com