The data released by the end of the North American session on Friday, as well as the presentation of the representative of the US Federal Reserve Williams, did not lead to a serious change in bullish or bearish sentiment. However, the market remains on the side of dollar buyers, as a number of investors after the release of the US unemployment report expects a more rapid further increase in interest rates from the Central Bank in 2019.

According to the CME Group and the Federal Reserve Futures Market, the likelihood of a rate hike rose to 87% against 80% in December of this year at the end of last week and against 76% a week ago.

US Fundamental Data

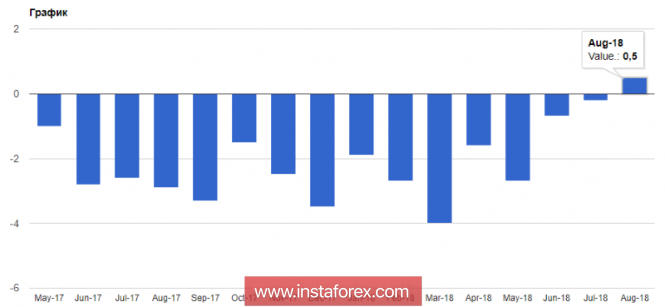

According to the data, consumer lending in the United States increased significantly in August of this year, which will support the economy in the 3rd quarter of this year. As stated in the report of the Federal Reserve System, unsecured consumer lending increased by 6.15% or $ 20.08 billion, while economists had expected lending to grow by $ 14 billion.

Card loans for the reporting period increased by 5.60%, while non-revolving loans showed an increase of 6.35%.

Fed spokesman Williams said on Friday that the data showed strong employment growth, noting positive signs of accelerated wage growth in the United States, adding that low unemployment is not scary at all. Williams also believes that market participants have no worries about inflation, as the dynamics of markets reflect a strong economy.

The representative of the Fed reiterated the fact that the committee focuses only on economic data, and the prospects for interest rates depend on the situation in the economy. Williams also does not see a high risk that monetary tightening will undermine economic growth.

As for the technical picture of the EUR/USD pair, significant changes are unlikely to occur in the market today, as a number of US exchanges will be closed due to the celebration of Columbus Day. The main technical picture remains on the side of the euro sellers, and the breakdown of the intermediate support of 1.1500 or fixing under it will be an additional signal to the resumption of the downward trend in risky assets with a minimum of 1.1450 and 1.1400. In the case of an upward correction, which is unlikely to persist for a long time, short positions in euros can return on a rebound from the upper limit of 1.1550.

Canada

The Canadian dollar continued to decline against the US dollar, despite data on the growth of the surplus in Canada and the labor market.

According to a report from the Bureau of Statistics of Canada, foreign trade surplus amounted to 526 million Canadian dollars in August due to a sharp increase in exports and a reduction in imports. It is worth noting that the surplus was recorded for the first time since December 2016. The lack of foreign trade in July amounted to 189 million Canadian dollars against 114 million Canadian dollars.

According to a report by the National Bureau of Statistics of Canada, the number of jobs in Canada grew by 63,300 in September of this year, while economists had expected jobs to grow by 25,000.

As for the overall unemployment rate, it fell to 5.9%, which coincided with the expectations of economists. The average hourly earnings in September rose by 2.4% compared with the same period of the previous year.

The material has been provided by InstaForex Company -

www.instaforex.com