Fed Chairman Jerome Powell, speaking at the National Association of Business Economics, confirmed the Fed's policy of gradually increasing interest rates. Powell's confidence is based on some long-term trends that previously in the past fairly accurately reflected the relationship between Fed policy and the real state of the economy. In particular, Powell noted that unemployment in the United States has been at its lows over the past 20 years with stable inflation, favorable conditions will continue until at least 2020, and previously such periods have always been accompanied by accelerated inflation.

In recent decades, the relationship between these indicators has become somewhat weaker, that is, the Fed will focus on high employment, but there will be no rush to raise rates.

Thus, Powell reiterated the firmness of the Fed's course, aimed at a gradual tightening. From the text of the accompanying statement to the last meeting, the "soft" characteristic with respect to monetary policy disappeared, and the text itself was reduced by a third, that is, the Fed does not set itself the goal of informing the market in detail about its plans.

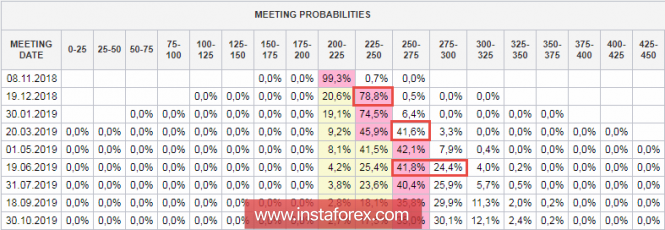

At the same time, despite the fact that the Fed left its forecast for the rate unchanged and focuses the markets on 3 increases in 2019, the CME futures market is far from being so unequivocal. The probability of a December rate hike is just over 80%, that is, the market is not completely sure, and the next increase is expected by most players no earlier than June 2019.

Thus, the position of the Fed is somewhat different from market forecasts. The Fed assumes that favorable conditions in the US economy will continue until the end of 2020, while some experts expect the inversion of the yield curve in the first half of 2019.

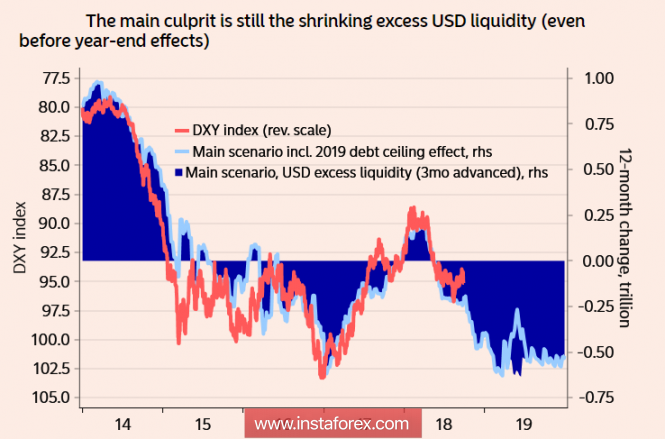

Powell's speech as a whole should support the dollar, but the main factor for strengthening should still be considered the reduction of the Fed balance sheet, withdrawing from circulation excess dollars issued during periods of quantitative expansion. In the 4th quarter, the volume of the monthly reduction increased to $ 50 billion. On Monday, the dollar strengthened slightly after the Fed had withdrawn another 19 billion from circulation the day before.

If the Fed's policy was the only factor determining the demand for the dollar, nothing would hinder its strengthening. However, in recent days, a number of market sectors have begun to grow, which indirectly indicates a weakening of the dollar's position in the medium term. The first growth was oil, and the markets were quick to explain this growth by preparing to leave the Iranian oil market due to sanctions and the likely increase in the supply deficit, but what about other commodity sectors? On Tuesday, gold prices rose noticeably, copper and aluminum quotations reached monthly highs, and in general, the industrial metals sector is recovering at a good pace, which can also mean a decrease in demand for protective assets. Goldman Sachs and Deutsche Bank predict further strengthening of gold, Nordea Bank expects the dollar growth period to end in the coming months, and before the end of the year, the markets will see the dollar index turning down.

The reason for such skepticism is the expectation that a number of central banks, and especially the ECB, are starting their own exit programs from soft monetary policy, which will help to reduce the yield spread. The second reason, no less significant, is the growing doubts that the Trump administration will be able to reformat foreign trade in its own favor and implement plans to repatriate capital and industrial production in the United States. Tax reform has led to a noticeable reduction in budget revenues, which, in turn, contributes to accelerating the level of public debt and the cost of its services, and compensating mechanisms that the Administration actively promoted by rewriting trade agreements will not be able to produce the expected effect.

In favor of this scenario, the latest ISM report on activity in the manufacturing sector. In September, the PMI index dropped to 59.8 pp versus 61.3 pp a month earlier, business sentiment is worsening. Today, market attention will be directed to a similar report in the service sector.

Before the publication of the labor report on Friday, the dollar will look confident, because at the current moment, the market expectations for a rise in the patch in September are positive.

The currency pair EUR / USD is trying to strengthen on Wednesday morning. However, they are likely to be used for new sales. During the day, the euro may fall to a minimum of 1.1509 week.

The currency pair GBP / USD will also decrease, reaching the level of 1.3030 will be used for sales, likely to decline to 1.2940 and further to 1.2895.

The material has been provided by InstaForex Company -

www.instaforex.com