The Fed left mixed feelings, which makes it difficult for the currency market to take direction. Today in the morning EUR loses bad news from Italy; CAD is under pressure through prolonged NAFTA negotiations, and NZD has not received new guidelines from a neutral RBNZ.

Today in the morning EUR is losing in connection with information from Italy, where, according to press reports, the government may postpone the meeting on the next year's budget. Members of the ruling League want to join the coalition project, the 5 Stars Movement, to establish a deficit of 2.4 percent. Previously, the deficit was closer to 2 percent, so this is a negative information. EUR / USD fell to 1.1704.

CAD is losing ground because NAFTA negotiations do not see the end. US President Trump said he was "very unhappy" about the style in which Canada is negotiating. Reports indicate that the agreement will not be reached by the end of September, as previously assumed. USD / CAD was pulled to 1.3050.

On Thursday, the 27th of September, the is light in the important data releases, however, the US session will bring some interesting macroeconomic figures to the market's participants attention. The US will publish Durable Goods Orders data, GDP data, Goods Trade Balance data, Wholesale Inventories data, Unemployment Claims data and Pending Home Sales data. There are some scheduled speeches from FOMC members Jerome Powell and Rober Kaplan at the end of the trading day.

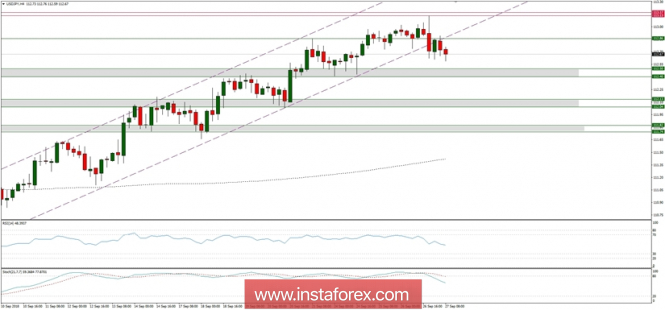

USD/JPY analysis for 27/09/2018:

The Federal Open Market Committee decided to raise interest rates and intends to tighten policy in the coming quarters, but this position was expected. In the projection for 2018-2020, nothing has changed and in the Fed's opinion, there are 5 more hikes ahead of us. Some dovish impulse gave the removal from the message of the "accommodative" fragment of politics, which at first glance suggests that the Fed is approaching a neutral attitude. However, at the conference, President Powell explained that the change in language reflects the expected path of normalization, and the removal of the phrase now "was not made because politics are not accommodative. It is still accommodative". Despite this, apart from the expected increase, the decision has no hawkish surprises and it is difficult to develop the USD rally.

Let's now take a look at the USD/JPY technical picture at the H4 time frame. The market made a new high just a few pips away from the technical resistance at the level of 113.17 and fell out of the channel. If the bearish pressure will increase, then the price might fall towards the level of 112.50 - 112.40, which will act as a technical support zone. Please notice, that in a case of a further sell-off, the next technical support zone is seen at the levels of 112.13 - 112.04. The market conditions are now overbought, which supports the short-term pull-back development.

The material has been provided by InstaForex Company -

www.instaforex.com