To open long positions on GBP / USD, you need:

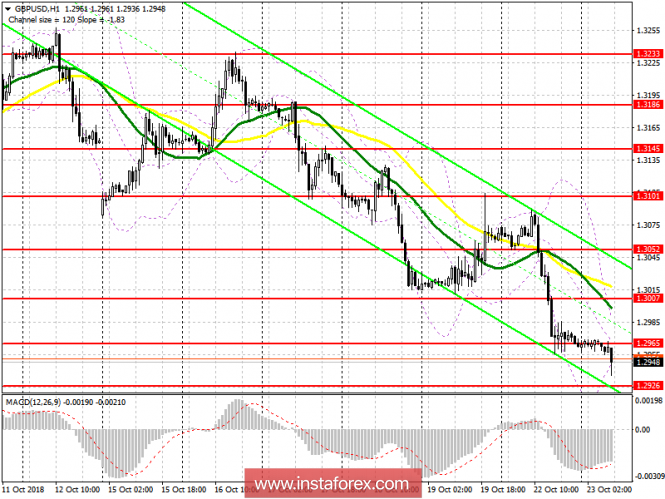

Pound buyers will try to return to the resistance level of 1.2965 in the first half of the day, and only fixing on it will allow us to expect a larger upward correction, which will be limited by the resistance level of 1.3007 and the upper limit of the downward channel, which passes just above this range. In the event of a further decrease in the pound, purchases can only be considered after a false breakdown in the area of 1.2926, and best of all, after updating the monthly lows in the areas of 1.2872 and 1.2831, where you can immediately buy for a rebound.

To open short positions on GBP / USD, you need:

Any negative news related to the British Prime Minister, who may be impeached, or to Brexit, will lead to a further decline in the pound. Repeated test of the support level of 1.2926 will crash GBP / USD already to monthly lows in the area of 1.2872 and 1.2831, where I recommend fixing the profits. In the case of a growth of the pound in the first half of the day, short positions can be searched around 1.3007, where the 50-day moving average is located, or to rebound from a maximum of 1.3052.

Indicator signals:

Moving Averages

Trade returned under 30 and 50 MA, indicating a further drop in the pound.

Bollinger bands

The upside potential is limited by the upper limit of the Bollinger Bands indicator in the 1.2985 area. A break of the lower border around 1.2945 will be a signal to open short positions in a pound.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company -

www.instaforex.com