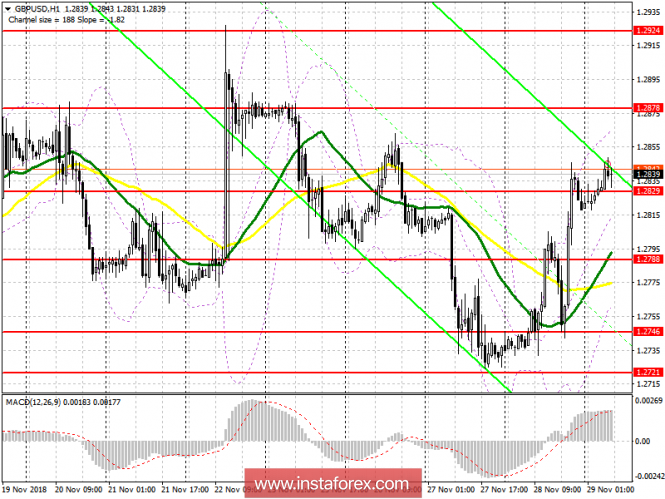

As long as trading continues above intermediate support 1.2829, demand for the pound will continue, and the formation of a false breakout at this level will be an additional signal to open long positions in order to break through and consolidate above the 1.2878 maximum. The main goal of the bulls will be the level of 1.2924, where I recommend to take profits. In the case of GBP / USD decline in the first half of the day, long positions can be viewed in the support area of 1.2788 or in a rebound from 1.2746.

To open short positions on GBP / USD you need:

Bears have to rely on the report of the Bank of England on Brexit. Any criticism can lead to a sharp sale of the pound. Breakthrough support 1.2829 opens a direct road to the area of a larger level 1.2788. The main task for the first half of the day will be fixing below 1.2788 with updating the lower border of the side channel 1.2746, where I recommend to fix the profit. In the case of a pound increase, you can take a closer look at short positions on the false breakdown from resistance 1.2878 or sell it for a rebound from 1.2924.

Indicator signals:

Moving averages

Trade is conducted above the 30- and 50-day moving averages, which indicates a likely change in trend.

Bollinger bands

A break of the upper border of the Bollinger Bands indicator around 1.2865 will lead to further growth of the British pound.

More details about the forecast can be found in the video review.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company -

www.instaforex.com