USD/CHF has been quite impulsive and non-volatile amid the bullish momentum which lead the price to push higher above 0.9850 area with a daily close. USD has been the dominant currency in the pair since the recent rate hike and ahead of the US NFP today. Thus, the pair is likely to trade with higher volatility today.

Throughout the week, CHF has been trading in a mixed manner in light of statistics from Switzerland. So, CHF has been able to show resilience to USD. Today Switzerland's Foreign Currency Reserves report is going to be published which is expected to increase from the previous figure of 731B and CPI report is also expected to increase to 0.2% from the previous value of 0.0%.

On the other hand, today US Average Hourly Earnings data is going to be published which is expected to decrease to 0.3% from the previous value of 0.4%, Non-Farm Employment Change is likely to decrease to 185k from the previous figure of 201k, and Unemployment Rate is expected to decrease to 3.8% from the previous value of 3.9%. Moreover, Trade Balance is assumed to decrease to -53.4B from the previous figure of -50.1B. Besides, FOMC Member Bostic is going to speak about the interest rates and future monetary policies, though his speech will hardly make an impact on the market today.

Meanwhile, CHF is quite optimistic and positive on the back of the economic reports, published today. On the other hand, USD is expected to halt its rally for a while. If USD is hurt by the economic data, then CHF might get certain momentum, which is expected to be quite short-lived. However, if the US non-farm payrolls reveal better-than-expected readings, USD will be struggling for gains against CHF.

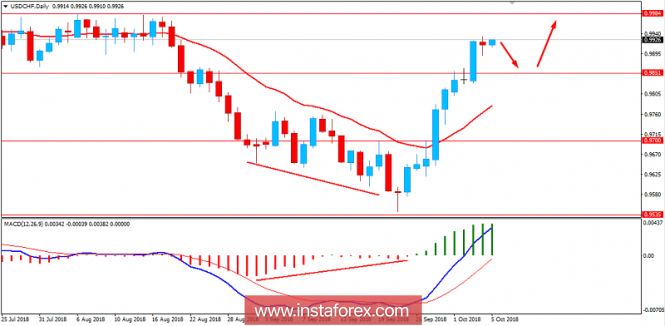

Now let us look at the technical view. The price has been quite indecisive yesterday after breaking above 0.9850 area with a daily close recently. The price is currently quite bullish but as per mean reversion theory, the price is expected to retrace towards the dynamic level, i.e. mean, before pushing higher again with the trend. As per current structure, the price is expected to retrace towards 0.9850 area to retest and reject the bears while also pushing higher with target towards 0.9980-1.00 resistance area in the coming days. As the price remains above 0.9850 area with a daily close, the bullish bias is expected to continue.

SUPPORT: 0.9850, 0.9550

RESISTANCE: 0.9980, 1.0050

BIAS: BULLISH

MOMENTUM: IMPULSIVE

The material has been provided by InstaForex Company -

www.instaforex.com