USD/CHF is currently pushing a bit higher after bouncing off the 0.9850-0.9920 area with a daily close which has optimistic structure to push higher as per the preceding trend. Ahead of the release of the FOMC and Federal Funds Rate report today, the pair is expected to be quite volatile while trying to push higher in the process.

This is the fourth time the US Central Bank Federal Reserve increases the interest rate time this year despite the pressure from President Donald Trump. Today, the Fed will probably increase its interest rate to 2.50% from the previous value of 2.25% which is expected to lead to certain gain on the USD side. Though today's rate hike is imminent, but the number of rate hikes in 2019 may be less than expected, which signals certain tightening of the monetary policy due to increased recession fears. Moreover, today, the US Current Account report is going to be published which is expected to decrease to -125B from the previous figure of -101B; Existing Home Sales is estimated to decline to 5.20M from the previous figure of 5.22M; and Crude Oil Inventories is also expected to fall to -2.7M from the previous figure of -1.2M.

On the CHF side, recently, SECO Economic Forecast has had the neutral effect leading to no massive gains or pressure from the CHF side in order to counter the impulsive bullish momentum set by USD. Today, SNB Quarterly Bulletin is going to be held, but with expectation of no major changes in the upcoming economic process. Moreover, tomorrow, the CHF Trade Balance report is going to be published which is expected to decrease to 3.20B from the previous figure of 3.75B.

As of the current scenario, USD is anticipated to gain further momentum against CHF with an imminent rate hike today, while CHF is struggling with the neutral and mixed economic results in the process. Since USD has managed to sustain the momentum for the coming days, further bullish pressure against CHF is expected in this pair.

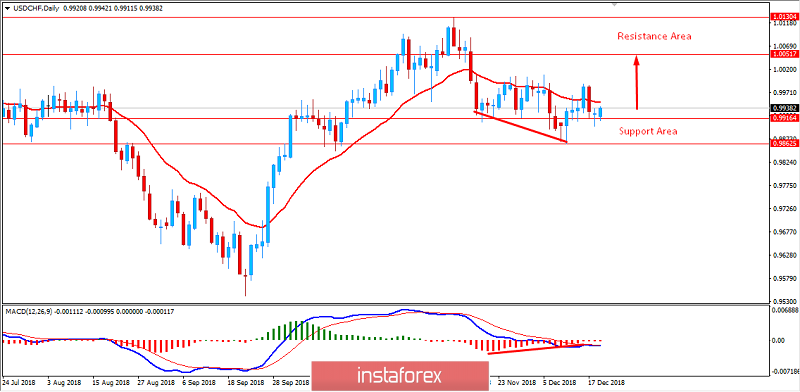

Now let us look at the technical view. The price has recently formed Bullish Continuous Divergence which is expected to lead the price higher in the process. As the price remains above the 0.9850 area with a daily close, it is likely to push higher towards the 1.0050-1.0130 resistance area in the coming days.

SUPPORT: 0.9850, 0.9920

RESISTANCE: 1.0050, 1.0130

BIAS: BULLISH

MOMENTUM: VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com