NZD/USD has been quite bearish recently after opening the market with a gap this week. The pair is trading lower below 0.69 with a daily close. Ahead of NFP reports, USD is currently quite indecisive whereas NZD is struggling for gains amid the recent economic reports. This may lead to downward momentum.

Recently New Zealand Overseas Trade Index report was published with a decrease to -0.3% from the previous value of 0.4% which was expected to be at 0.1% and ANZ Commodity Index report was published with an increase to -0.6% from the previous value of -2.4%. NZD is currently expected to stay low and stable, having already shed 3% of its value. The kiwi is expected to lose ground in the coming days, thus creating long-term pressure for the future.

On the other hand, USD has been stalled its growth amid the recent economic reports. As a result, the pair is trading indecisively with low liquidity. Ahead of the reports on the US labor market today, certain volatility may be observed on the USD side. Today US Average Hourly Earnings report is going to be published which is expected to increase to 0.3% from the previous value of 0.2, Non-Farm Employment Change is expected to decrease to 198k from the previous figure of 250k, and Unemployment Rate is expected to be unchanged at 3.7%. Though the expectations are mixed, certain optimistic bias can be observed in the market which might lead to certain gains on the USD side if better than expected economic figures are published today.

Meanwhile, USD may extend some gains ahead of upcoming NFP reports while New Zealand provides no economic data to deviate the upcoming pressure and bearish market bias. To sum up, USD is expected to gain certain momentum over NZD in the coming days.

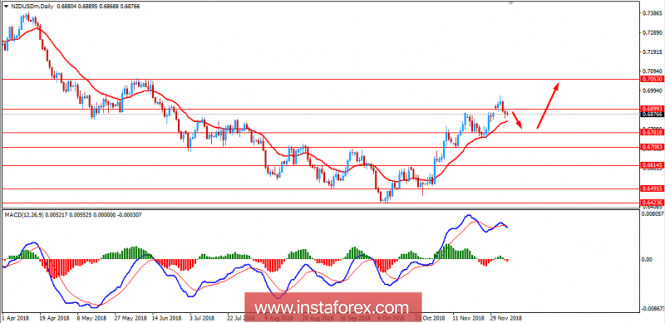

Now let us look at the technical view. The price is currently quite indecisive but having certain bearish pressure below 0.69 and forming Bearish Divergence in the process, is expected to lead the price lower towards 0.6780-0.6800 support area before pushing higher towards 0.7050 in the future. As the price remains above 0.6700 area with a daily close, the bullish bias is expected to continue.

SUPPORT: 0.6700, 0.6780-0.6800

RESISTANCE: 0.69, 0.7050

BIAS: BULLISH

MOMENTUM: NON-VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com