EUR/JPY has been quite volatile amid the nearish bias recently after consistent bullish momentum in the pair since it bounced off the 125.50 area on August. EUR has been the dominant currency in the pair, whereas JPY is to blame for further weakness against the EUR.

This week, despite fresh worse-than-expected economic data from Japan, the JPY growth against EUR remains unaffected. JPY mainly gained momentum after ECB conference which revealed the dovish stance. Besides, the the eurozone released a series of downbeat PMI reports. Today no macroeconomic reports are published, but on Friday Japan's Household Spending report is due which is expected to decrease to 0.0% from the previous value of 0.1%, Average Cash Earnings is expected to decrease to 1.3% from the previous value of 1.6% but Leading Indicators is expected to increase to 104.3% from the previous value of 103.9%.

On the other hand, EUR has been still quite mixed in light of recently published economic data which maintained the indecisive momentum for the currency in the market. Despite the German Unity Day holiday, today Spanish Services PMI report was published with a decrease to 52.5 from the previous figure of 52.7 which was expected to increase to 52.9, Italian Services PMI increased to 53.3 from the previous figure of 52.6 which was expected to be at 52.8, French Final Services PMI increase to 54.8 which was expected to be unchanged at 54.3, and German Final Services PMI decreased to 55.9 which was also expected to be unchanged at 56.5. Moreover, the eurozone's Final Services PMI was published unchanged as expected at 54.7 and Retail Sales report was published with a slight increase to -0.2% from the previous value of -0.6% but failed to meet the expectation of 0.2%.

As Japan presents no economic data till Friday, EUR could take advantage and gain certain momentum. But indecisive readings held the price back in the range with no definite pressure on either side of the market. If Japan's economic reports show better-than-expected figures in the coming days, the bearish pressure is expected to extend further.

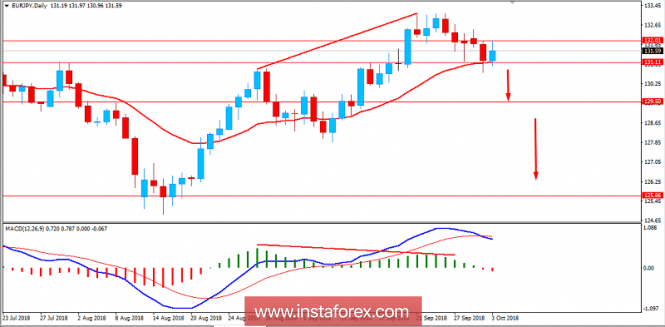

Now let us look at the technical view. The price has been quite impulsive with the bullish gains today which started with a bounce off the dynamic level of 20 EMA and 131.00 support area. Despite the long-term bullish pressure, the price has been quite impulsive with the recent bearish momentum which is expected to continue pushing further lower if the price manages to break below 131.00 area with a daily close leading the price towards 129.50 area in the coming days. As the price remains below 132.00 area, the bearish pressure is expected to continue.

SUPPORT: 131.00, 129.50

RESISTANCE: 132.00

BIAS: BULLISH

MOMENTUM: VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com