AUD/JPY moved higher quite impulsively today despite an impulsive bearish daily close recently below 80.50 area. AUD strengthened against JPY thanks to positive economic data and events, held today. On the other hand, JPY is struggling to gain momentum despite upbeat reports as well.

AUD was being dominated by JPY since the price bounced back from 82.00 area which lead the price to reside below 80.00 area recently. Today Australia's MI Inflation Expectations report was published unchanged at 4.0% which did not quite affect the growth of AUD, but Reserve Bank of Australia's Assistant Governor Ellis was quite optimistic with her speech today. Ellis predicted expansion of the Australian economy both in the short and long run that changed the market sentiment from bearish to bullish. Moreover, tomorrow Australia's Home Loans report is going to be published which is expected to decrease to -0.9% from the previous value of 0.4% and RBA Financial Stability Review is due which expected to provide the currency with support.

On the JPY side, despite positive economic data, it struggled to gain sustain the momentum it had over AUD earlier. Today Bank of Japan Lending report was published with an increase to 2.3% from the previous value of 2.2% which was expected to decrease to 2.1% and PPI was unchanged at 3.0% which was expected to decrease to 2.9%.

Meanwhile, JPY is struggling to keep momentum despite upbeat economic reports. This indicates a directional bias or shift of market sentiment which is currently in favor of AUD. As AUD continues to perform better amid upcoming economic reports, further bullish momentum is expected in this pair, leading to higher volatility.

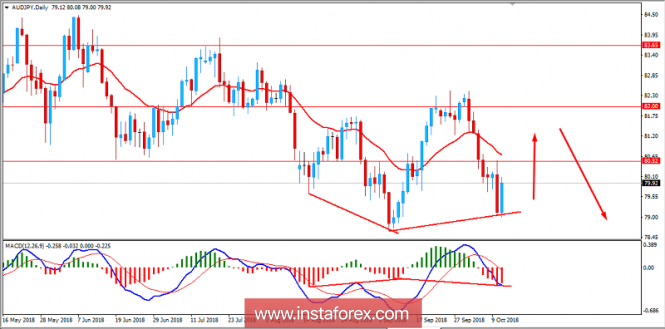

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains while Bullish Convergence in line indicates further bullish momentum in the pair with a target towards 82.00 area in the future. The current trend is still bearish, though with bullish spikes and higher volatility. The price is expected to climb higher in the coming days before continuing with the trend to push lower in the coming days. As the price remains below 82.00 area, the bearish bias is expected to continue.

SUPPORT: 78.50

RESISTANCE: 80.50, 82.00

BIAS: BEARISH

MOMENTUM: VOLATILE

The material has been provided by InstaForex Company -

www.instaforex.com