Dear colleagues.

For the currency pair Euro / Dollar, the price is near the limit values for the downward structure of November 7, in connection with which, we expect a rollback up. For the Pound / Dollar currency pair, we are following the development of the downward structure from November 7 and we expect the continuation of the downward movement after the breakdown of 1.2834. For the currency pair Dollar / Franc, we are following the development of the upward cycle from November 7 and we expect the continuation of the upward movement after the breakdown of 1.0111. For the currency pair Dollar / Yen, we are following the development of the upward trend from October 26 and we expect the continuation of the upward movement after the breakdown of 114.21. For the Euro / Yen currency pair, we are following the development of the downward cycle of November 8. At the moment, the potential target is 127.22. For the Pound / Yen currency pair, the continuation of the development of the downward structure of November 8 is expected after the breakdown of 145.82.

Forecast for November 13:

Analytical review of H1-scale currency pairs:

For the Euro / Dollar currency pair, the key levels on the H1 scale are: 1.1301, 1.1266, 1.1246 and 1.1212. Here, the price is near the limit values for the downward structure of November 7, and therefore, we expect a rollback to the top. The breakdown of the level of 1.1212 will be accompanied by an unstable trend development. In this case, the goals are not defined.

The short-term uptrend is possible in the range of 1.1246 - 1.1266 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1301 and this level is the key support for the downward structure. Its breakdown will have to form the initial conditions for the upward cycle.

The main trend is the downward cycle of November 7, we expect to go into a correction.

Trading recommendations:

Buy 1.1246 Take profit: 1.1264

Buy 1.1268 Take profit: 1.1300

Sell: Take profit:

Sell: Take profit:

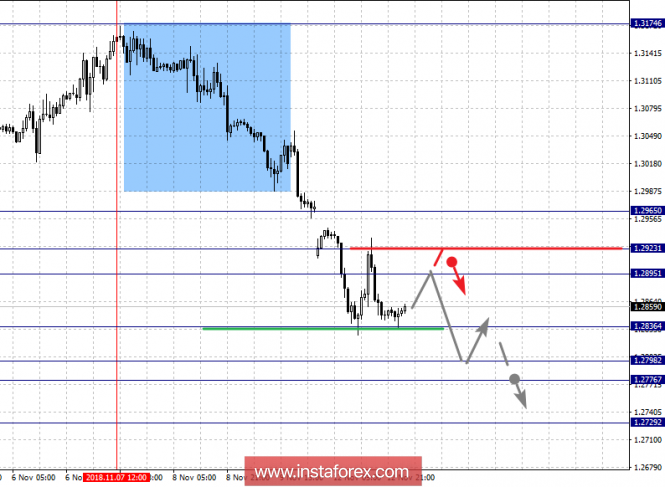

For the Pound / Dollar currency pair, the key levels on the H1 scale are: 1.2965, 1.2923, 1.2895, 1.2836, 1.2798, 1.2776 and 1.2729. Here, we are following the development of the downward structure of November 7. A downward movement is expected after the breakdown of 1.2836. In this case, the target is 1.2798 and in the range of 1.2798 - 1.2776 is the price consolidation. The breakdown of the level of 1.2776 will lead to the development of a pronounced movement. In this case, the potential target is 1.2729, upon reaching which we expect a rollback to the top.

The short-term uptrend is possible in the range of 1.2895 - 1.2923 and the breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2965 and this level is the key support for the downward structure. Its breakdown will have to form the initial conditions for the upward cycle.

The main trend is the downward structure of November 7.

Trading recommendations:

Buy: 1.2895 Take profit: 1.2920

Buy: 1.2925 Take profit: 1.2965

Sell: 1.2834 Take profit: 1.2800

Sell: 1.2774 Take profit: 1.2732

For the Dollar / Franc currency pair, the key levels on the H1 scale are: 1.0186, 1.0150, 1.0134, 1.0111, 1.0082, 1.0065 and 1.0043. Here, we are following the rising structure of November 7th. The upward movement is expected after the breakdown of the level of 1.0111. In this case, the target is 1.0134 and in the range of 1.0134 - 1.0150 is the price consolidation. The potential value for the top is considered the level of 1.0186, upon reaching which we expect a rollback downwards.

The short-term downward movement is possible in the range of 1.0082 - 1.0065 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.0043.

The main trend is the upward cycle of November 7.

Trading recommendations:

Buy: 1.0111 Take profit: 1.0134

Buy: 1.0152 Take profit: 1.0184

Sell: 1.0082 Take profit: 1.0067

Sell: 1.0063 Take profit: 1.0045

For the Dollar / Yen currency pair, the key levels on the scale are: 115.01, 114.48, 114.21, 113.77, 113.46 and 112.99. Here, we are following the development of the upward cycle from October 26. At the moment, the price is in the correction area. The short-term upward movement is expected in the range of 114.21 - 114.48 and the breakdown of the latter value should be accompanied by a pronounced upward movement. Here, the potential target is 115.01, after reaching which we expect a downward rollback.

The short-term downward movement is possible in the range of 113.77 - 113.46 and the breakdown of the last value will lead to a prolonged correction. Here, the goal is 112.99, up to this level, we expect the initial conditions for the downward cycle.

The main trend is the ascending cycle of October 26, the correction zone.

Trading recommendations:

Buy: 114.21 Take profit: 114.46

Buy: 114.50 Take profit: 115.00

Sell: 113.75 Take profit: 113.50

Sell: 113.44 Take profit: 113.15

For the Canadian dollar / Dollar currency pair, the key levels on the H1 scale are: 1.3363, 1.3314, 1.3279, 1.3215, 1.3190 and 1.3151. At the moment, we expect to move to the level of 1.3279 and the breakdown of which will lead to a short-term uptrend to the level of 1.3314. In this range is the price consolidation. The potential value for the top is considered the level of 1.3363, upon reaching which we expect a rollback to the top.

The short-term downward movement is possible in the range of 1.3215 - 1.3190, hence a high probability of a reversal upwards. The breakdown of the level of 1.3190 will lead to a prolonged correction. In this case, the target is 1.3151.

The main trend is the local rising structure of November 7.

Trading recommendations:

Buy: 1.3280 Take profit: 1.3312

Buy: 1.3316 Take profit: 1.3360

Sell: 1.3215 Take profit: 1.3194

Sell: 1.3188 Take profit: 1.3155

For the Australian dollar / dollar currency pair, the key levels on the H1 scale are: 0.7234, 0.7206, 0.7191, 0.7157, 0.7145, 0.7123 and 0.7090. Here, we follow the development of the downward structure of November 8. We expect the downward movement to continue after the price passes the range of 0.7157 - 0.7145. In this case, the target is 0.7123 and price consolidation is near this level. A potential value for the downward trend is considered to be the level of 0.7090, after reaching which we expect a rollback to the top. The most likely development of the correction is expected from the level of 0.7123.

The short-term upward movement is possible in the range of 0.7191 - 0.7206 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.7232 and this level is the key support for the downward structure.

The main trend is the downward cycle of November 8.

Trading recommendations:

Buy: 0.7191 Take profit: 0.7204

Buy: 0.7208 Take profit: 0.7230

Sell: 0.7145 Take profit: 0.7125

Sell: 0.7120 Take profit: 0.7095

For the Euro / Yen currency pair, the key levels on the H1 scale are: 128.90, 128.46, 128.03, 127.76, 127.22, 126.95 and 126.41. Here, we are following the downward cycle from November 8. At the moment, we are waiting for the movement to the level of 127.22 and the breakdown of which will lead to a short-term downward movement in the range of 127.22 - 126.95. The potential value for the bottom is considered the level of 126.41, upon reaching which we expect a rollback to the top.

The short-term uptrend is possible in the range of 127.76 - 128.03 and the breakdown of the last value will lead to a prolonged correction. Here, the goal is 128.46 and this level is the key support for the top. It will have a breakdown to the formation of initial conditions for the upward cycle. In this case, the goal is 128.90.

The main trend is the downward cycle of November 8.

Trading recommendations:

Buy: 127.76 Take profit: 128.00

Buy: 128.06 Take profit: 128.42

Sell: 127.20 Take profit: 127.00

Sell: 126.95 Take profit: 126.50

For the Pound / Yen currency pair, the key levels on the H1 scale are: 147.46, 146.90, 146.58, 145.82, 145.22, 144.50 and 143.89. Here, we follow the development of the downward structure of November 8. The downward movement is expected after the breakdown of 145.82. In this case, the target is 145.22 and in the range of 145.82 - 145.22 is the consolidation of the price. The breakdown of the level of 145.20 will lead to a pronounced movement to the level of 144.50. The potential value for the bottom is considered the level of 143.90, after reaching which we expect a rollback to the correction.

The short-term upward movement is possible in the range of 146.58 - 146.90 and the breakdown of the latter value will lead to an in-depth correction. Here, the goal is 147.46 and this level is the key support for the downward structure.

The main trend is the downward cycle of November 8.

Trading recommendations:

Buy: 146.58 Take profit: 146.90

Buy: 146.95 Take profit: 147.44

Sell: 145.80 Take profit: 145.25

Sell: 145.15 Take profit: 144.50

The material has been provided by InstaForex Company -

www.instaforex.com