The US dollar was under pressure from trading on Tuesday because of the threat of a new financial crisis.

The index of economic optimism from IBD / TIPP rose in October to 57.8p. against 55.7p. A month earlier, the result confidently exceeded the forecast but failed to support the dollar. Markets are concerned about a marked increase in the likelihood of a new wave of economic crisis, clear signs of the approach of which are expressed in a simultaneous decrease in stock and debt markets.

The yields of 10-year treasures reached 3.26%, which is more than the 7-year maximum, and the yields of European, British, and Japanese bonds increase proportionally. By 2020, the US budget deficit will exceed $ 1 trillion; there is no reason to expect stabilization in the foreseeable future. The situation is aggravated by the approach of elections to Congress, the two main options for the development of the crisis, depending on who wins, are reduced to one final result. The growth of public debt, the growth of interest payments, the budget deficit and the rapid recession.

On Wednesday, the dollar looks weak, sales may continue against most competitors.

Eurozone

The budget crisis in Italy remains the center of attention in Europe. Despite the fact that Italy is only the third largest economy in the eurozone, the problem goes far beyond the Apennine Peninsula, primarily because it revealed an extremely negative trend.

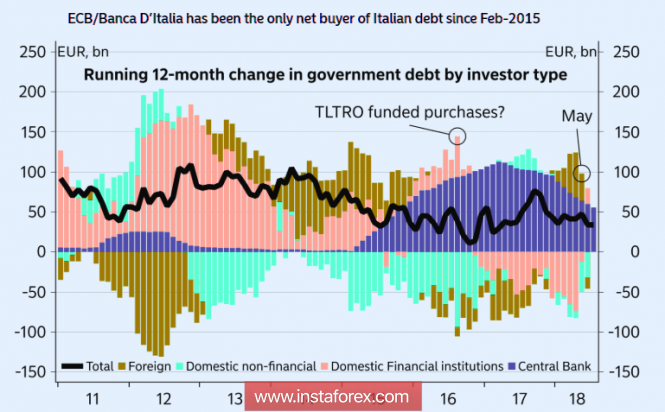

Since the opening of the ECB PSPP program, the only source of financing for the Italian deficit has been Banca D'Italia. Since February 15, it has acquired 100% of Italian debt. In other words, there is currently no investor in the world willing to finance the Italian government, and the question is, who will finance the budget deficit after the ECB stops buying bonds at the end of the year?

If the issue is not resolved, in order to avoid a default, Italy will have to follow the path of Greece, but given the size of the Italian economy, this path is unacceptable for the ECB. Money simply cannot be found. It should also be borne in mind that the development of the crisis will cast doubt on the ECB's long-term plan for exiting soft monetary policy and push the date for the first rate increase from the summer of 2019 into uncertainty.

A reduction in the expenditure side of the budget will inevitably lead to a government crisis, new elections, and in the end, it will, in the same way, put pressure on the euro.

On Tuesday, a negative report on the foreign trade of Germany added, the reduction in exports and especially imports significantly exceeded forecasts.

Today, EUR / USD will trade sideways. Its own problems will not allow the euro to develop an upward correction, but a weak dollar will compensate for this factor. The resistance of 1.1525 and 1.1590, the achievement of more distant is unlikely, support of 1.1474 and 1.1432.

The United Kingdom

The pound is trying to develop corrective growth amid reports of positive outcomes of the Brexit talks. The likelihood that the parties will be able to reach a compromise is growing, a positive result will be a long-term driver to recover the pound.

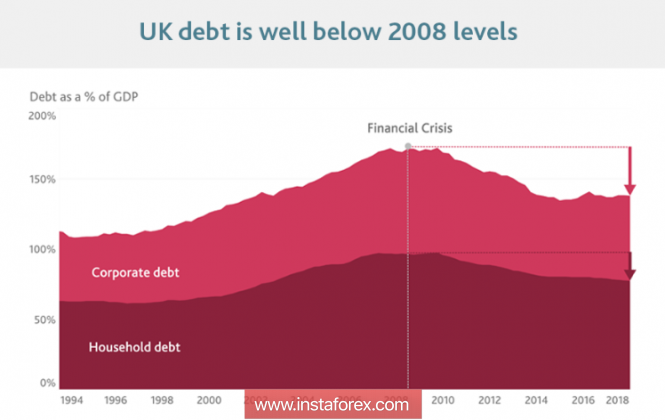

The Bank of England Financial Policy Committee issued a regular quarterly report in which it claims that the UK financial system is resistant to a wide range of risks. The aggregate ratio of tier one capital in large British banks is about three times more than a decade ago; levels of family and corporate debt in the UK relative to income remain substantially below the 2008 level.

Today, a report on industrial production and foreign trade is expected in August. Expectations are neutral, strong deviations from forecasts are capable of changing the pound movement vector. In the meantime, GBP / USD has a chance to test the nearest resistance at 1.3217 and further 1.3297, support 1.3104.

The material has been provided by InstaForex Company -

www.instaforex.com