The European currency and the British pound continued to decline against the US dollar after the Federal Reserve raised interest rates in the US, as well as against the background of excellent fundamentals in the US economy, which were published yesterday afternoon.

Despite the fact that the US is close to the end of a soft monetary policy, demand for the US dollar will continue in the short term, as investors expect another increase in interest rates this year.

Fundamental data

As I noted above, good data on the US economy supported the dollar, which led to a fall in the pairs EUR / USD and GBP / USD.

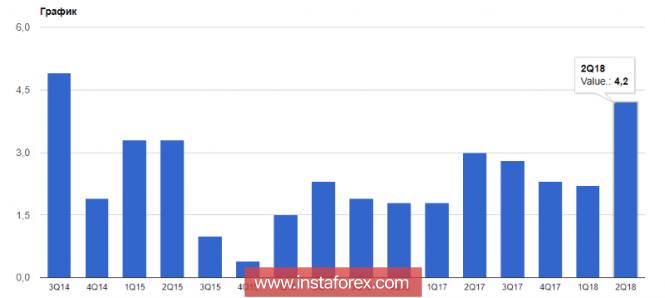

According to the US Department of Commerce, the US economy continued to grow at a strong pace in the second quarter of this year, but a slight slowdown is expected in the third quarter of this year.

Thus, the growth in US GDP in the second quarter of 2018 was 4.2% per annum, which fully coincided with the latest estimate, which was published in August. Economists had expected the figure to be revised upward, to 4.3% per annum.

The growth of consumer spending and the increase in exports, along with large capital investments of companies, led to the preservation of good economic growth. It is expected that the country's economy will continue to grow at a strong pace in the 3rd quarter. Today in the afternoon, there are data on consumer spending and incomes of US citizens, which need to pay special attention.

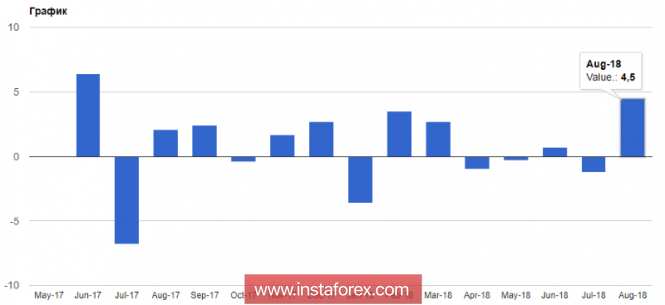

Good support for the US dollar was provided by the report on demand for durable goods, which grew in August this year due to the increase in the number of orders for aircraft. According to the US Department of Commerce, orders for durable goods in August rose by 4.5% compared with the previous month. Economists had expected an increase of 2.1%.

As I noted above, growth was due to orders for civilian aircraft, which increased by 69.1%, while orders for cars and parts in August decreased by 1% compared with the previous month.

The US labor market remains in good order, despite the insignificant weekly number of applications for unemployment benefits. According to the US Department of Labor, the number of initial applications for unemployment benefits for the week from 16 to 22 September increased by 12,000 and amounted to 214,000. Economists had expected the number of applications to be 206,000.

The number of signed contracts for the sale of housing in the United States has decreased, which indicates a continued decline in activity in the housing market due to an increase in the cost of borrowing. According to the National Association of Realtors, the index of signed contracts for the sale of housing in the US on the secondary market in August this year decreased by 1.8% compared to the previous month and amounted to 104.2. Economists had expected a decline of 0.4% in August. Compared to the same period of the previous year, the index fell by 2.3%.

The speech of the Fed Chairman, which was scheduled for the afternoon half yesterday, led only to the strengthening of the American dollar.

Fed Chairman Powell said that the US economy is in good shape, and unemployment and inflation are low, but not all Americans have experienced an improvement in the economic situation.

He also noted that the Federal Reserve has shown sufficient patience without raising rates for several years after the crisis to stimulate economic growth. However, at the moment, there is no longer any need to tighten with the increase in rates, and the equalization of the yield curve does not yet give grounds for believing that the probability of a recession in the next two years will be increased.

Technical picture EUR / USD

Most likely, the pressure on the European currency will continue today, and a breakthrough of the support level around 1.1620, to which I have repeatedly drawn attention, will lead to a continuation of the decline in risky assets with access to weekly lows of 1.1570 and 1.1540. The task of buyers for today will be the retention of the trading instrument above support 1.1620, which may trigger the closure of a number of short positions in the second half of the day and the growth of the euro towards resistance 1.1660.

The material has been provided by InstaForex Company -

www.instaforex.com