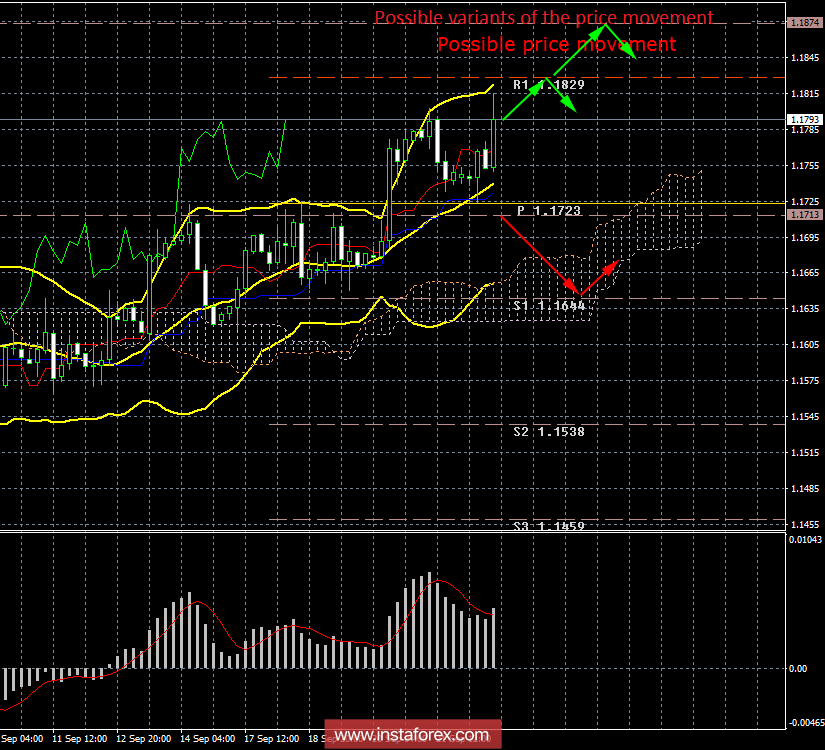

4-hour timeframe

The amplitude of the last 5 days (high-low): 80P – 73p – 65p – 116p – 70p.

The average amplitude over the last 5 days: 81p (87p).

The first trading day of the week was quite active. The euro updated Friday's high, intending to continue the uptrend. On this day, trade duties totalling $200 billion against China came into effect. And a similar duty against the US in the amount of $60 billion. The markets reacted by selling the dollar. Thus, we can once again state that Trump killed two birds with one stone at the same time. The dollar is declining, tariffs against China are being introduced. And this is not the limit. It is expected that the US leader will introduce a third package of duties on the remaining share of imports from China, which is about 267 billion dollars. If a month ago it was possible to expect the strengthening of the US currency on such news, now the dollar is more likely to fall. One way or another, as technical indicators continue to signal upward movement. Therefore, there are no compelling reasons to open short positions at the moment. Even if the market reacts to this or that news with purchases of the US dollar, it will be no more than a correction. Macroeconomic reports were not published on Monday. By the way, the price also bounced off the critical Kijun-sen line, which is a buy signal. This week there will be a meeting of the Federal Reserve, and the main issue of this event is the question of raising the key rate. Recall that Trump has already criticized Powell for too rapid tightening of monetary policy. However, the Fed is beyond Trump's control, so the question is, will Powell meet the US President?

Trading recommendations:

For the EUR/USD, the correction ended near the Kijun-sen line. Thus, it is now recommended to trade on the increase with the first target of 1.1829, and then – to 1.1874.

It is recommended to consider sell orders only below the critical line. In this case, the "golden cross" will be weakened, and the trend will be able to change to a downward one. The first target for the downward movement is 1.1644.

In addition to the technical picture, fundamental data and the timing of their release should also be taken into account.

Explanation of illustration:

Ichimoku Indicator:

Tenkan-sen – red line.

Kijun-sen – blue line.

Senkou span a – light brown dotted line.

Senkou span B – light purple dotted line.

Chikou span – green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD:

Red line and histogram with white bars in the indicator window.

The material has been provided by InstaForex Company -

www.instaforex.com