To open long positions for EUR / USD, you need:

Serious buyers in the formation of a divergence on the MACD indicator in the morning was not, which led, after a short pause, to a further decline in EUR / USD. The pressure was also created due to weak data on inflation in the euro area. At the moment, you can count on growth in the area of support 1.1574 when forming a false breakdown there, but it is best to open long positions for a rebound from the minimum of 1.1532. The main task of buyers for the second half of the day, except for the retention of the level of 1.1574, will be a return to the resistance of 1.1615.

To open short positions on EUR / USD you need:

Bears remain in the market, and the repeated test of support 1.1574 will also lead to its breakdown, which will open a direct road to a minimum in the area of 1.1532, where I recommend fixing the profits. In the case of euro growth in the second half of the day, short positions can be returned immediately to the rebound from resistance 1.1615 and 1.1648.

Indicator signals:

Moving Averages

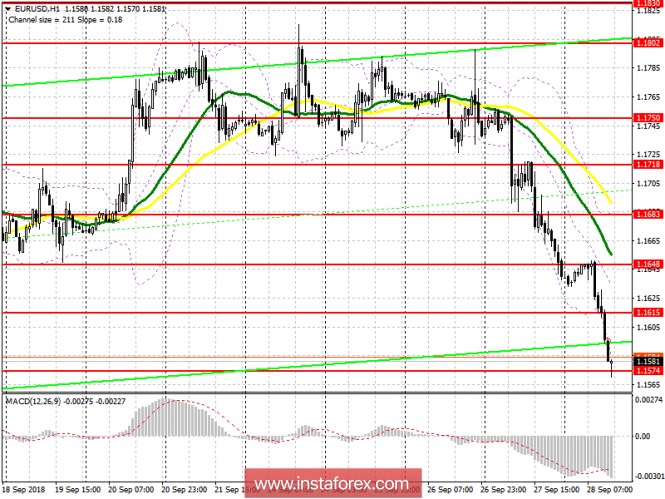

The 30-day moving average and the 50-day average are down, indicating a continued decline in the euro in the short term.

Bollinger Bands

The lower boundary of the Bollinger bands only for a while kept the euro from falling in the morning. As long as trade is conducted below the middle of the channel, pressure on the euro will continue.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

The material has been provided by InstaForex Company -

www.instaforex.com