To open long positions for EUR / USD, you need:

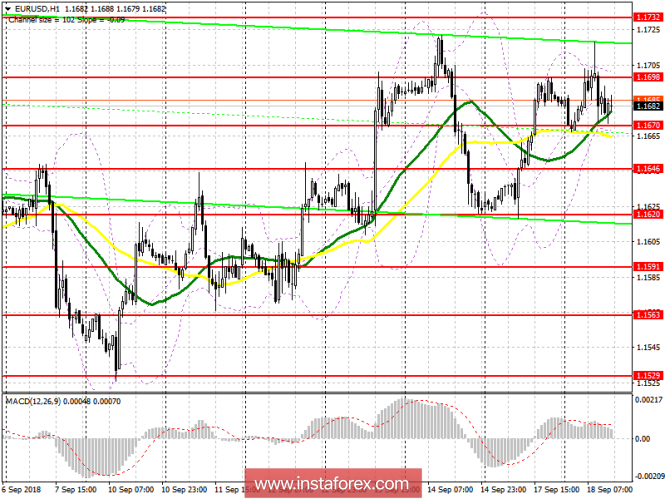

In the first half of the day, buyers of the European currency did not cope with the important task of keeping the support level at 1.1698, as a result of which trade moved under this range, seriously limiting the further upward potential of the euro in the short term. In the afternoon, I recommend buying back the euro only after the formation of a false breakdown at 1.1670 or a rebound from the larger support 1.1646. The goal of Euro will be a break and close of the day above the resistance of 1.1698, which will allow to expect to update the high of 1.1732.

To open short positions for EUR / USD, you need:

Mario Draghi did not deal with the topic of interest rates during today's speech, which limited the upside potential of the euro. The sellers returned to the level of 1.1698, which led to the formation of pressure on the pair, which is maintained at the time of writing. The main task will be a repeat test and a breakdown of support 1.1670, which will lead to a larger sale of the euro in the area 1.1646 and 1.1620, where I recommend fixing profits. Breakthrough 1.1670 will also move the trade under the 30- and 50-day moving average, which will clearly be a bearish signal. If the euro rises above 1.1698 in the afternoon, you can immediately sell at a rebound of 1.1732.

Indicator signals:

The 30-day moving average is on par with the 50-day average, which indicates the lateral nature of the market.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Band

The material has been provided by InstaForex Company -

www.instaforex.com