To open long positions for EUR / USD pair, you need:

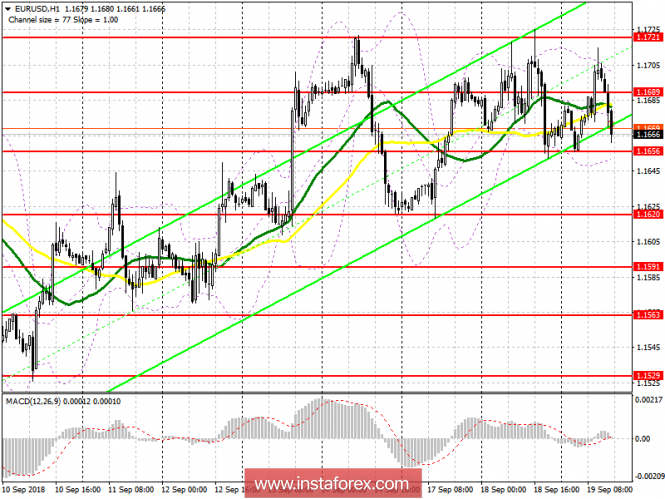

The trade remained in the side channel, and the breakthrough of the resistance level at 1.1690 in the morning has again not helped the buyers. Now, we can count on retaining the support at 1.1656. It is best to open long positions in euros from this level after the formation of a false breakdown on it. In the other scenario for purchases, it is best to count after the weekly minimum test in the area of 1.1620. The main task by the end of the day will be a return and consolidation on the resistance of 1.1689, after which, it will be possible to talk about the continuation of the EUR/USD upward trend.

To open short positions for EUR / USD pair, you need:

The sellers returned to the level of 1.1689, and its repeated test on the volume which is already from below to top will serve as a signal for the opening of new short positions with a decrease and update of the low of yesterday at 1.1656. Only a breakthrough of 1.1656 will lead to a reversal of the upward trend, which is still in euro that will allow us to expect a descent to the lows in the area of 1.1620 and 1.1591, where fixing profits are recommended. If EURUSD rises above 1.1689 and in the afternoon, sales can also be expected from resistance at 1.1721.

Indicator signals:

Moving Averages

The 30-day moving average is on par with the 50-day average, which indicates the lateral nature of the market.

Bollinger Bands

The sellers fulfilled the upper limit of the indicator 1.1709, which led to a fall in the euro in the morning.

For purchases, you can return to the rebound from the lower boundary of Bollinger Bands, located in the area of 1.1648.

Description of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company -

www.instaforex.com