To open long positions on EUR / USD pair, you need:

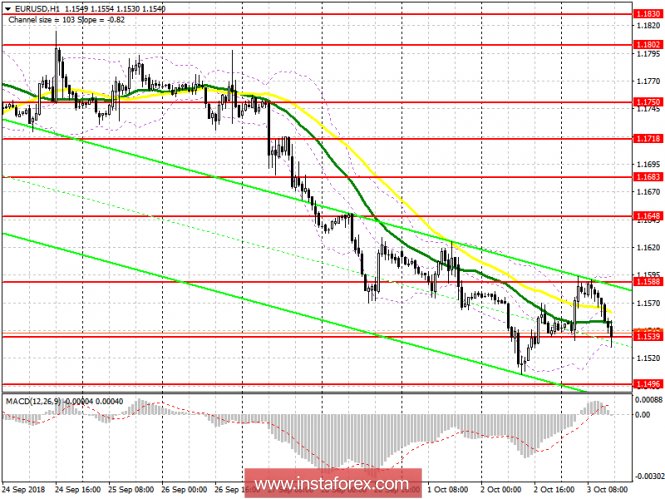

Buyers have lost their advantage in the morning and are now trying to cling to the support level of 1.1539, which I paid attention to in my morning review. Only the formation of a false breakout will signal to buy euros in order to return and update the daily maximum, above which the bears are unlikely to start up the market today. In the case of a decline below the support area of 1.1539, it is best to return to long positions in the EUR / USD pair to rebound from a new low of 1.1496.

To open short positions on EUR / USD pair you need:

A Breakthrough and consolidation below 1.1539 will be an additional signal for sellers that they are acting in the right direction. The main task for the second half of the day will be to update the weekly minimum in the area of 1.1496, where fixing profits are recommended. In the case of EUR / USD growth, short positions can return immediately to the rebound from the daily maximum around 1.1588.

Indicator signals:

Moving averages

The price has returned under the 30- and 50-day average, and if the sellers manage to hold on until the close of the day under the moving averages, the pressure on the euro will most likely increase again with a new force.

Bollinger bands

Support is provided by the lower limit of the Bollinger bands in the area of 1.1530, however, its breakthrough will be a signal to increase in short positions of the European currency.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company -

www.instaforex.com