To open long positions for EUR / USD pair, you need:

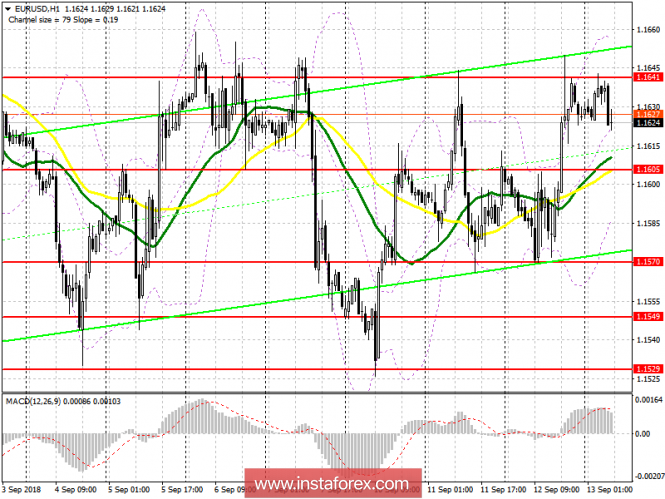

Long positions in the euro can be seen after the decrease to the middle of the channel in the support range of 1.1600-1.1605. The formation of a false breakdown will allow us to count on the repeated growth of EUR / USD to the weekly highs in the area of 1.1640 and their breakdown, which will lead to a new uptrend with the test of the area 1.1686 and 1.1730, where fixing profits are recommended. In case of a decline under the support level 1.1605 in the morning, the euro can be bought immediately for a rebound from the lower border of the channel at 1.1570.

To open short positions for EUR / USD pair, you need:

Sellers hold the pair under the resistance level of 1.1641, and it is already clear that the main move will depend on the ECB's decision on interest rates, as well as on comments made by the president of the central bank. If you can not get above 1.1641 in the morning, you can see the euro sales in terms of return and consolidation under the support level 1.1605, which will lead to a larger sale with a minimum test of 1.1570 and 1.1549, where fixing profits are recommended. In case of EUR / USD growth above 1.1641 resistance, opening short positions is best for a rebound from 1.1686.

Indicator signals:

The 30-day moving average is on par with the 50-day moving average. This suggests that the trade will be conducted in the side channel

Description of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company -

www.instaforex.com