4h

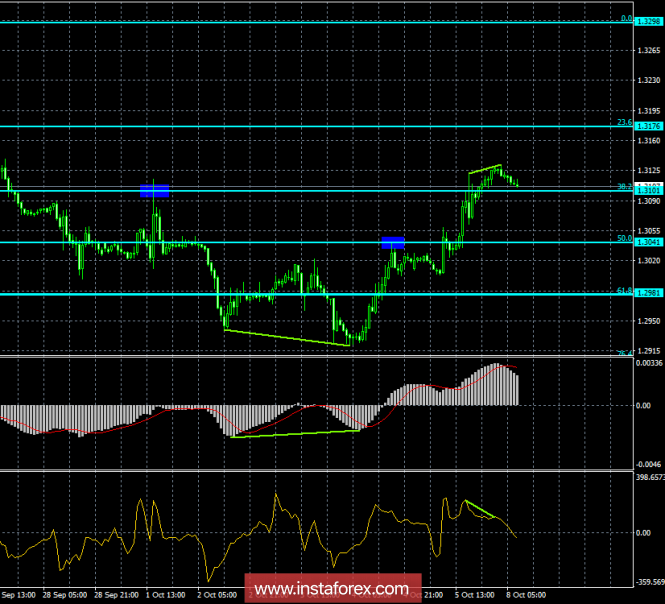

The GBP / USD currency pair consolidated above the correction level of 23.6% - 1.3067 and continues the process of growth in the direction of the Fibo level of 38.2% - 1.3316. The maturing bearish divergence at the MACD indicator allows traders to expect a reversal in favor of the American dollar and a resumption of decline in the direction of the correction level of 0.0% - 1.2662. Fixing the rate under the Fibo level of 23.6% will similarly work in favor of the US dollar.

The Fibo grid was built according to extremums of April 17, 2018, and August 15, 2018.

1h

On the hourly chart, the quotes of the pair completed above the correction level of 38.2% - 1.3101. However, the bearish divergence allows traders to expect a reversal in favor of the US currency and a slight drop in the pair. Fixing quotes below the Fibo level of 38.2% will increase the probability of a fall beginning in the direction of the correctional level 50.0% - 1.3041. A pair of the last divergence peak will work in favor of the pound sterling and continuing growth in the direction of the next correction level of 23.6% - 1.3176.

The Fib net is built on extremums from September 5, 2018, and September 20, 2018.

Recommendations to traders:

New purchases of the GBP / USD currency pair can be made with the target of 1.3176 and a Stop Loss order under the correction level of 38.2% if the last divergence peak is passed (hourly chart).

To sell the currency pair GBP / USD it will be possible with a target of 1.3041 and a Stop Loss order above the level of 38.2% if the pair closes below the Fib level of 1.3101 (hourly chart).

The material has been provided by InstaForex Company -

www.instaforex.com